What are Qualified Opportunity Zones?

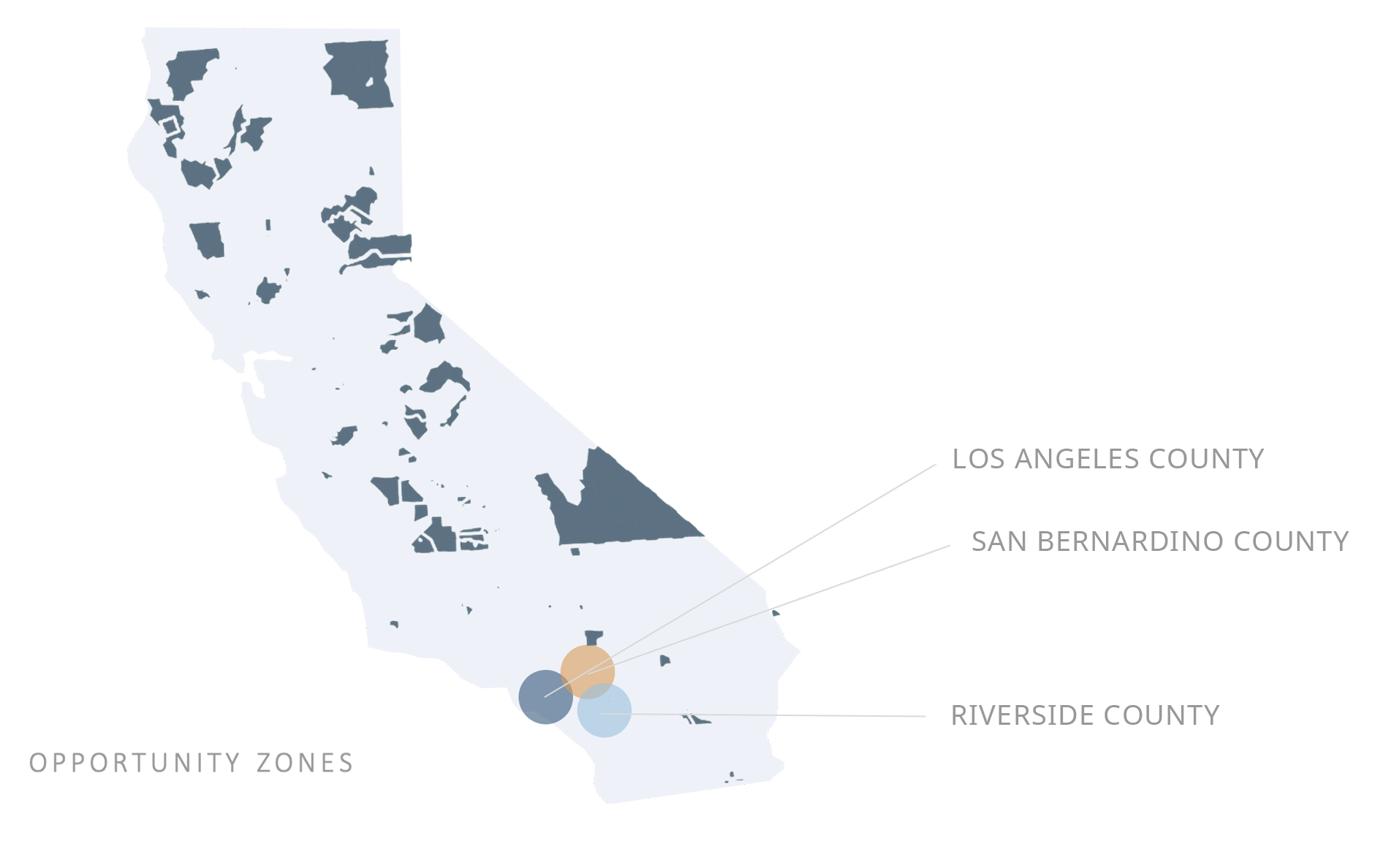

The Tax Cuts and Jobs Act of 2017 created Qualified Opportunity Zones (QOZ) to provide potentially significant tax benefits to investors who re-invest capital gains into long-term investments into communities designated for economic development. This solution is useful for investors who have substantial capital gains and a desire to realize them in a tax-efficient manner. As seen in the map below, these Opportunity Zones can be found in all 50 states in the US, the District of Columbia, and five US possessions.

Explore the map to see which communities have been designated as Opportunity Zones.

Map Source: EIG.org